Today’s blog post about overcoming limiting beliefs is a guest post written by H. J. Chammas following his recent appearance on my podcast The Segilola Salami Show. H. J. shares with us some limiting beliefs and how we can overcome them on our journey to financial freedom.

H. J. Chammas’ childhood

When I was a teenager, I always used to wonder why my parents were so adamant about their children seeking higher education so that they would get a secure, high-paying job. My parents themselves have spent their adult lives as employees going through the ups and downs of the employee life. They were at times put out of their jobs and then forced to pay for less paying and less rewarding jobs. They worked very hard for money to provide the best they can for their family. When they retired, they woke up to the realisation that neither their previous employer nor the government will look after them. My parent retired broke, and luckily enough I had the means to take care of their needs when they were out of money after their legal retirement age.

Back then during my childhood, I observed that the parents of my wealthy classmates did things quite differently from the route my parents selected for themselves. When I used to visit their houses for play days, even as a young child, it was obvious to me that my wealthy classmates’ lifestyle was quite far from the lifestyle our family was enjoying … or not enjoying!

When I grew a bit more mature, I automatically fell into the same “life programming,” and as soon as I graduated, I started my career in the corporate world. I found myself trapped in the rat race, running from one pay check to the next. My corporate life allowed me great exposure to working with my colleagues from the different corners of the world. I also have worked as an expatriate in different countries for almost 17 years. I realised that almost all my work colleagues, irrespective of where they fall on the corporate ladder, irrespective in which country they live and work in, all had accepted their fate and were trying to make the most out of the life program that their parents handed over to them.

In overcoming limiting beliefs, first review your financial situation

When I started my wealth-building journey, my starting point was taking a proper inventory of my financial situation. When I had a look at my first ever personal financial statement, dozens of questions and ideas came to my mind. In some instances, I comforted myself with some irrational justifications about my financial ruin. It was like covering a bad story with another bad story. Finally, I had to face reality and objectively analyse what brought me to this situation. During this same time, I looked at Forbes’s list of billionaires and started to ask myself questions about how those billionaires and other wealthy people attract money like a magnet, whereas people like me and my fellow colleagues, employees in general, seem to repel it.

Being determined to discover the answers, I talked to dozens of people, including ones who were poor, middle class, well off, and wealthy. As I met people who were low-, medium-, and high-paid employees, self-employed, investors, and business owners, I began to notice that people who depend on earned income, irrespective of their income level, have much in common. On the other hand, people who have acquired multiple streams of income from their income-producing assets also share a lot in common. The difference between those classes was astonishing.

How does the beliefs of a wealth builder differ to that of an income earner?

People who have accumulated wealth have let go of an incredible number of misconceptions and limiting beliefs. In fact, the wealthy have managed to subscribe to a new set of empowering beliefs that contradict what the majority of the population still hangs onto.

It appears as if we are all programmed to believe in a set of false assumptions that become limiting beliefs. Too often the poor and the middle class hold tightly to a set of limiting beliefs about money and investing. Meanwhile, those same beliefs hold them captive and prevent them from achieving financial freedom.

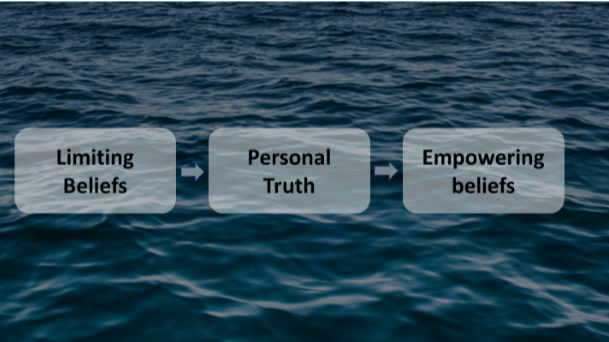

When I first looked at my personal financial statement, I had the same set of limiting beliefs. It was only when I understood how those beliefs were enslaving me to a state of financial ruin that I managed to let go of them. I had to understand the personal truth about my negative thoughts in order to overcome them and replace them with empowering beliefs.

After going through those beliefs, you will see how the poor and middle class look at them differently—actually in opposite ways. The poor and the middle class have adopted limiting personal beliefs, whereas the wealthy have adopted empowering personal beliefs. You’ll never embark on the road to wealth if you let such negative thoughts constrain you.

The poor and the middle class will most probably remain in the same financial situation if they conjure up any number of excuses for not choosing wealth—excuses that say more about their inner thoughts than about the difficulty of achieving wealth.

In overcoming limiting beliefs, you need to unearth your personal truths

If you’re embracing negative thoughts, you need to understand what they really mean. It’s time to dig deep and unearth your personal truths. Jot down negative statements you whisper to yourself, and, after some honest soul searching, record the personal truth that lies beneath each. Once you become honest with yourself and accept that those beliefs are limited only to the extent you allow them to be, you will experience a transformation of those beliefs into empowering ones. Self-awareness is critical in this transformation. Before you change your life, you need to change your mind. Your thoughts and beliefs are deeply entrenched, so deeply rooted that you may not even be aware of how much they’ve impacted your financial situation.

Below is a selection of those limiting beliefs. For a complete list of all the limiting beliefs and the respective strategies to transform them into empowering beliefs, I am offering 2 free ebooks, which will put you on the right track to start building wealth and achieve financial freedom:

The 4 Stage of Building Wealth: www.employeemillionaire.com/the4stages

Break Out of Your 9-5 Job: www.employeemillionaire.com/breakout

Limiting Belief 1: A job provides financial security for now and at retirement

Almost all of the poor and middle class were programmed to graduate from school to seek a high-paying job that would provide them security and eventually lead them to wealth. This might hold true for CEOs and other corporate executives with hefty pay cheques.

But to the majority of employees, this remains a dream they chase until one day they retire, only to be surprised by a bank account and pension plan that can barely sustain their lifestyle for a few weeks or months. Then reality kicks in—when it is too late. The fact of the matter is that a job, for the majority of us, merely supports the basics of life, the essential expenses.

The drug that keeps all employees addicted to their job is seeing their income increasing from the day they start working till the prime of their income-earning years. This false evidence of prosperity leads to a false feeling of security. As a result, more and more of their income gets channeled to discretionary expenses, and those who can afford it start to spend on the appearances of wealth. One day their income starts to go downhill, and like a drug addict who cannot have the same high doses of drug anymore, they wake up to the fact that this fantasy is over and that they have to cut down on their expenses. The few exceptions will be corporate executives, who are only a minority of the general population.

I encourage you to start looking at your job in a different way. Consider it as a form leverage that acts in your favor. It is about having your job work smarter for you while you work hard for your job. It’s a win-win term.

“The Employee Millionaire” program

The objective of “The Employee Millionaire” program is to enable you to leverage your position as an employee to qualify for bank loans (good debt) to purchase income-producing assets that will generate unearned income in excess of your monthly expenses and therefore put you on the road to being wealthy.

As you may know, banks generate profits from lending money to people. The interest they charge the borrowers is the bank’s income. Banks like to lend money to creditworthy people. They want reasonable reassurance that borrowers have steady incomes that will enable them to repay their loans. Banks will look at the length of time the borrowers were in their current jobs as their reassurance of steady income. The first step of the wealth building process is to take advantage of the fact that you have a steady income that qualifies you for a loan that you can take to purchase income-producing assets.

Limiting Belief 5: Failure is bad, and mistakes are a reflection of my incompetence

Most of us fear failure and mistakes, which is no surprise. Throughout our years at school and university, failing an exam resulted in a feeling of shame and incompetence. Even in most of our life as employees, failure to deliver on our objectives will eventually lead to a bad performance evaluation, and in extreme cases the door will be wide open for us to leave our job.

Some mature companies accept failure as part of the learning curve of their employees, but those failures need never be experienced more than once, and they should not lead to a major financial loss. In other words, those mature companies are projecting an image of a culture that welcomes failure as part of a learning organization. But when the shit hits the fan, the employee who made a mistake will be looking for a new job in a new company sooner rather than later.

In my professional life as an employee, I used to fear making large mistakes. But in my professional life as an investor, I have made rather large mistakes and realized that failure is an integral part of my success. When I learned how to convert “fear of failure” into “opportunity of failure”, I developed creativity, flexibility, agility, and the ability to explore new ways of achieving my goals.

In fact, the biggest mistakes I have made in my investment life have taught me lessons not only about how to avoid them in the future. The solutions to those mistakes have taught me more important lessons about how my how-to can become more rigid and can deliver better results.

When you fail in an important endeavour, you affiliate yourself with some of the most famous people in the world. I am confident you know two famous quotes from Thomas A. Edison, known as America’s greatest inventor. One quote is “I have not failed. I’ve just found ten thousand ways that won’t work”, and the other one goes “Many of life’s failures are people who did not realize how close they were to success when they gave up”. The moral of the story is that you fail only when you give up.

Another impressive story is that of Abraham Lincoln, who served as the sixteenth president of the United States. After facing several failures, such as losing his job, failing in business, having a nervous breakdown, being defeated for speaker of the house, being defeated for nomination in Congress, being defeated for the US Senate, and being defeated for nomination for vice president, he overcame each of them as it was time for a better outcome, and was eventually elected president. He is also famous for saying “Always bear in mind that your own resolution to succeed is more important than any other”. What those great achievers taught us is that determination for success will keep us going and trying again and again until we succeed. Who we become in the process becomes as important as success itself.

In summary, I encourage you to start “learning to learn” by learning to unlearn in order learn again and again.

Limiting Belief 6: It takes money to make money

A common objection I often hear from starting investors is … “it takes money to make money”.

Indeed, it takes money to make money, but who said it has to be your money? In an earlier article, I have shared one of the best lesson my mentor, Papa Joe, ever taught me: “The road to wealth is good debt”. Check out this article, it has explained in depth the principles of borrowing and leverage to create wealth.

The reality is a large amount of money is required for investment in assets such as rental properties. Most of us do limit our own selves with thoughts such as: “I can never save that amount of money!” … So, we end up spending our hard-earned money on discretionary expenses.

It is only through the wise use of good debt that returns can reach high double digits. In the best scenario—when you don’t use a single dollar from your own money to purchase income-producing assets—your returns can be infinite.

I invite you to transform this limiting belief into an empowering one – Indeed, it takes money to make money, but who said it has to be my money?

With this kind of thoughts, you will start he road to wealth is good debt. I will become as rich as the amount of good debt I take in my life. I shall begin managing my expenses to save money and eventually invest it and use leverage to accelerate my returns on investment.

Limiting Belief 11: All the good investments are taken. Only the mediocre and bad investments are left over to the small investors

Most unknowledgeable people are cynical about investment. They often claim that all good investments are taken and that only the mediocre and bad investments are left over for small investors.

Savvy investors wouldn’t miss opportunities to make good investments. Why can’t you join the league of those investors? In fact, the marketplace is a dynamic place, with economic forces and personal forces always at work, generating a continuous flow of investment opportunities.

Economic forces such as interest rates, employment rates, population growth, population shifts, and area developments all have major impact on the market. As a result, prices of properties might be driven up or down. Such economic forces are big and are on the news to an extent that they may often mask the impact of personal forces in putting opportunities in the market.

For example, personal situations like marriage, divorce, increase in the size of a household, relocation, death, inability to pay a mortgage, and family disputes over inheritance all present opportunities in the market. Those personal forces present more opportunities at discounted prices just because those people want to get rid of a property for personal reasons sooner rather than later. Such personal factors have always been there and will always remain there.

Further reading

To learn more about how to leverage your day job to become financially free visit www.employeemillionaire.com.

Follow me on my blog https://employeemillionaire.blogspot.com/

To your success.

H.J. Chammas

Multi-Award-Winning Author

Helping Employees Become Millionaires.

***

What do you think about this guest post Overcoming Limiting Beliefs That Make You Stand in Your Own Way to Becoming a Millionaire by H.J. Chammas? Please leave a comment below