Are you a parent looking to teach your children about money? Do you want action steps you can take to help your kids learn how to manage money? Then, today’s blog post, which is a guest post written by Will Rainey on How to teach your kids to manage money is just for you.

Are we doing enough when it comes to money management?

As parents we want to make sure our kids are ready for the real world when they become adults. This includes helping them with their schooling, making sure they stay healthy and getting them to work hard. However, there is one area that is so often overlooked …. making sure you teach your kids how to manage money.

Today there are so many young adults who are suffering from financial stress as they were thrown into the real world without being taught how to manage money. For our kids, the potential financial stresses are likely to be greater than any generation before them. I’ll go through why this is the case shortly. Before I do, I want to say that there is good news. If parents do spend a small amount of time to help their kids learn the basics of money management, it can make a real difference to their future financial wellbeing. It is well known that teaching kids about money improves their lives. It improves confidence, self-esteem, and life choices. It also reduces money worries and has a hugely positive impact on their mental health.

In this blog I’ll go through some of the simple things you as parents can do to help you teach your kids how to manage money. Before that, let me go back to why it is so important to teach them about money.

The NEED for you to teach your kids about money management

The NEED for parents to teach their kids about money

Teaching your kids about money isn’t just a ‘nice to have’ but is increasingly becoming a ‘need to have’ for your kids. Compared to generations before them, our kids need to learn about money for the following three reasons:

1. Our kids will have less money to spend

2. There is more pressure for our kids to spend

3. There is more need for our kids to spend

Let’s take a bit of time to go through these three points in turn.

1. Our kids will have less money to spend

As parents we are all probably a bit naive about what money we’ll have when we retire. Most of us have some money in our company pension scheme(s) and the option to ultimately downsize our house to release some capital. We’ll hopefully have some savings and possibly receive some inheritance money. This combined is hopefully enough to survive on despite the fact we are expected to live longer and medical costs are on the increase compared to our own parents. There remains the risk we don’t have quite enough money and will need to make some material changes to our lifestyle in our ‘golden years’. We may have to downgrade our supermarket of choice and opt for a staycation instead of a vacation.

What about our kids’ generation? Company pensions are getting worse, not better. Final salary pension schemes are becoming extinct. Our kids might not be able to get on the property ladder or, if they do, there might not be much scope to downsize if they had to buy small. As we as their parents are expected to live longer and will need to spend more there is unlikely to be much inheritance left to give them!

All in all, they really can’t rely on what we and our parents have to rely on. At least us as parents have a chance of a modest retirement pot. Our kids need to make sure they know about money asap!

2. There is more pressure for our kids to spend

Our kids will more exposed to social pressure and targeted advertising than any generation before them. Essentially companies and people are finding new ways to make us spend our money. With kids being so exposed to these pressures from a young age, combined with how easy it is to spend money, it is easy to see how our kids can end up spending more money they have, on things they don’t really need, to impress people they don’t really like when they become adults.

3. There is more need for our kids to spend

Our parents had it much easier than us. They had student grants where as we had student loans. They had affordable housing where as we are lucky to find an affordable house within an hour of our work. They didn’t even have university tuition fees in the UK (before 1998).

If you think we’ve got it bad – this is nothing compared to what our kids will have to deal with. They will need even more money.

Whilst we had student loans, the interest we paid on them was low. My student loan from the early 2000’s grew only by inflation. Today, depending on a student’s graduating salary, student loans can start to increase by inflation plus 3% per annum. They need to find this extra 3% per annum from somewhere. That’s the rate today and who knows what the rates could be in future.

I don’t think I need to say too much about housing but I struggle to see a world where housing in 15 years time is more affordable than it is today (relative to salaries). Given housing is crazy expensive already, I doubt our kids will be able to buy their own place until they are over 30 unless they start saving and investing now!

If your kids don’t know how to money money then they are likely to walk into this bleak financial world with their eyes closed.

Whilst there are some charities helping schools to teach your kids how to manage money, there is not enough being done. This means we as parents need to be the ones to help our kids learn to manage money. You might be thinking that this is too hard as we were never taught about money ourselves. Luckily, it only takes a few changes to make a real difference in order to get them to learn about money.

So what do you need to do to teach your kids how to manage money?

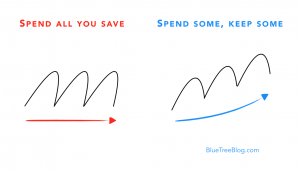

The future financial wellbeing of our kids is determined by the money habits that they form. The key is to make sure they form good habits.

Let’s think about that for a minute. It’s not how much money they will earn. It’s not how good they are with numbers. It’s not how much money their parents have. The key factor is what habits they form that makes the biggest difference.

I know people who earn a lot of money but are financially stressed as they have bad money habits. I know people from rich families that are financially stressed. On the other hand, I also know people who don’t earn much but don’t have any money worries because they have good money habits.

Therefore we need to help our kids form good habits and provide them with the knowledge as to why these habits are so important.

Here are my three essential money habits you should help your kids form:

1. Get them to save at least 10% of all the money they receive for the long-term.

This habit is to put money away, no matter how small away for the long term. This money isn’t to be spent but to be put away in a bank account or an investment account to grow. This habit helps them see that even putting small amount away means they see their money growing. One of the key pieces to help your kids learn is that you can save money to help make money. If they put a bit of money away, that money can grow and they will start to see that the interest will start generating them more money.

So compared to so many young adults that have no savings. Your kids will have some savings and this money will be making them money whilst they are sleeping.

2. Get them to save up for something they want

We live in a world where people expect to get what they want straight away (instant gratification). We need to teach our kids to wait (delay gratification). By getting our kids to plan out what they want and how they are going to save for it will really help them learn this skill. By delaying what they spend on they also end up spending less on things they don’t really want. How many of us have spent money on a whim and then regretted wasting that money as we didn’t really want or need it?

3. Get them to record how much money they have

One of the main reasons people end up in financial stress is that they spend more than they earn. Most of the time this is due to them not knowing what money they have. Therefore, by getting your kids in the habit of recording what money they have each month they will see over time whether this is growing or shrinking. Remember, “what gets monitored, gets managed”. This doesn’t have to be a full budgeting exercise. Just have a place for them to write down how much they have in cash and their bank account(s). It also helps open the conversation about money with you and therefore reduce the ‘taboo’ status that money has.

There you have it – three relatively simple but powerful money habits to help you teach your kids how to manage money and make a real positive impact to them in the future. Don’t underestimate the power of these habits.

Financial education and pocket money

The above habits are there to help you make a quick impact on your kids future financial wellbeing. To reinforce these habits parents should look for different opportunities to speak to their kids about money. There are also looks of financial education resources available for parents to help teach them about money at www.bluetreeblog.com/blog-finder. The blogs help you learn different topics and engaging ways to teach your kids these lessons.

For books and games to help you teach your kids how to manage money then here are some recommendations: www.bluetreeblog.com/resourceswww.bluetreeblog.com/resources.

Lastly, if you can, I would recommend you give your kids some pocket money, regardless how small the amount. This allows your kids to start handling money and making money decisions. It will really help them start forming the above money habits regardless how young or old your kids are.

CONCLUSION:

Don’t delay and start teaching your kids how to manage money today! They will thank you for it when they are older.

About Will Rainey

After 17 years working as an investment advisor to some of the largest asset owners in the world (retirement schemes, central banks, insurances), Will Rainey is now the Founder of Blue Tree Savings. Blue Tree Savings provide articles, guides and articles to help parents teach their kids about money. Blue Tree also provides a tool to help parents use their existing investment account to save for their kids, with their savings being shown as Blue Trees so they can watch their forest grow as they save.

***

There you have it: How to teach your kids to manage money

If this article resonated with you, then I think you would be interested to know about the Segilola Salami Preparatory School.

Like this article, I do believe that children today need to learn about how to manage money. However, even more so, I think children today need to learn how to make money.

In addition to the reasons listed above, our children will be faced with more competition than we did in the past. With the growth in robotics and artificial intelligence, this becomes even more noticeable. Not only will our children compete with each other, they’ll be competing with technology too. Their ability to think outside the box is part of what will set them apart from their peers in the future.

And that’s what the Segilola Salami Preparatory School was founded to address. SSPS is a skills acquisition business school for children aged 6 to 14. The school’s curriculum is based on STEAM education but with an enrichment element that includes business management, sales and marketing. On graduation, students would not only have learned different skills in different fields but also be able to start up and run a successful business. You can find out more about the Segilola Salami Preparatory School on the school’s website https://www.school.segilolasalami.co.uk/child-centred/https://www.school.segilolasalami.co.uk/child-centred/

What are your thoughts??

The three essential money habits you’ve mentioned are invaluable and will undoubtedly make a significant impact on their future financial well-being. It’s alarming to realize the financial challenges our children will face compared to previous generations, and your practical advice on saving, delaying gratification, and tracking their finances is crucial for their success.

Thank you for stopping by. I’m glad you found the post useful. As a mum myself, these are some of the steps that I take with my own child and I think it has helped in changing the way she looks at life and money in general

Very informative blog. Simple, effective, and useful too. Continue to enlighten us with your knowledge. Thanks for sharing.

children’s book series about money recently posted…Aliens are coming